Blog ›

Unearned Revenue: What It’s, How It Is Recorded And Reported

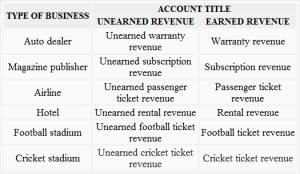

Unearned revenue is useful to cash flow, in accordance with Accounting Coach. Unearned revenue and deferred revenue are related, referring to income that a business receives but has not yet earned. However, since the enterprise is yet to provide precise items or services, it considers unearned revenue as liabilities, as defined further below. Earned income, also recognized as acknowledged revenue, is revenue that has been earned by providing goods or companies. It is recorded as income on the income assertion when it’s earned, no matter when the cost is acquired.

Subsequently, unearned income legal responsibility would decrease, and income would be acknowledged monthly. As a result, the electrical utility may have as a lot as one month of bills (cost of fuel and other operating expenses) without the related income being reported. Due To This Fact, at every balance sheet date, the utility must accrue for the revenues it earned but had not but recorded. This is completed via an accurual adjusting entry that debits a balance sheet receivable account and credit an revenue assertion revenue account.

Income Assertion

A business will need to record unearned income in its accounting journals and balance sheet when a buyer has paid in advance for a great or service which they haven’t but delivered. As Soon As it’s been provided to the customer, unearned income is recorded after which changed to normal revenue inside a business’s accounting books. As Soon As items or companies have been rendered and a customer has received what they paid for, the enterprise will need to revise the previous journal entry with another double-entry.

Underneath the liability methodology, you initially enter unearned income in your books as a money account debit and an unearned revenue account credit score. The debit and credit are of the identical quantity, the usual in double-entry bookkeeping. The first journal entry displays that the enterprise has received the money it has earned on credit score.

Step 2: Recognize Income Over Time As Obligations Are Fulfilled

Unearned income is initially entered within the books as a debit to the cash account and a credit to the unearned revenue account. Deferrals like deferred income are generally utilized in accounting to accurately document earnings and expenses in the interval they really occurred. An instance of deferred income is a retainer payment charged by legislation firms. When a authorized practice charges a new client a $10,000 retainer fee, it isn’t immediately recorded as income in its books. It information it as deferred revenue first, and only information $10,000 in revenue after the entire retainer charge has been earned. For assist creating steadiness sheets that can observe unearned revenue, think about using QuickBooks Online.

- Let us perceive how unearned income stability sheet documentation is carried out with the help of some examples.

- This cycle of recognizing $5 at a time will repeat every month as Magazine Inc. points monthly magazines.

- Let’s look at how this works under the completely different accounting techniques.

- Allocate that amount on your books to recognize the revenue as soon as the business obligation has been satisfied.

- Trust is required as a end result of it’s rare for cash and items to exchange palms simultaneously.

If the complete amount isn’t used, the firm might refund the client or apply the remaining balance to future providers. Then, on February 28th, when you receive the money, you credit accounts receivable to decrease its worth while debiting the money account to indicate that you have acquired the cash. Nonetheless, since you have not yet earned the income, unearned revenue is shown as a legal responsibility to point that you still owe the consumer your companies. Stripe Income Recognition streamlines accrual accounting so you can shut your books quickly and accurately. Automate and configure revenue stories to simplify compliance with IFRS 15 and ASC 606 revenue recognition standards.

This permits firms to plan forward, allocate assets, and operate with out relying on credit score or uncertain future gross sales. Unearned income liability arises when payment is acquired from clients before the services are rendered or items are delivered to them. Unearned income is commonest amongst firms selling subscription-based merchandise or different companies that require prepayments. Unearned revenue is recorded as a credit score to the unearned revenue account, which is a liability account. It represents a debt the company owes to its prospects within the form of goods or services. In the accounting world, unearned revenue is money collected by an organization earlier than providing the corresponding items or providers.

Unearned income is the revenue acquired by a person or a corporation for a product or service that is yet to be delivered. It is documented as a legal responsibility on the balance sheet because it represents a debt or outstanding stability that is owed to the shopper. At this level, you may be questioning how to calculate unearned income appropriately. When a buyer prepays for a service, your corporation unearned revenue might want to adjust its unearned income balance sheet and journal entries.

Your earnings assertion should not report unearned revenue until it becomes ‘earned’ income when the service or product is delivered. Unearned revenue, also known as deferred income or advanced fee, is money that has been paid to your small business for items or companies that you haven’t yet delivered. Basically, it is a money prepayment in trade for the promise of goods or services. Recording unearned income is critical if you’re utilizing the accrual accounting method and receiving a lot of advance payments. Once a delivery has been accomplished and your corporation has finally offered pay as you go items or companies to your buyer, unearned revenue could be converted into income in your stability sheet.

If you are unfamiliar with ASC 606, I strongly suggest you read the associated article for now and take the time to go over the entire doc along with your accountant in some unspecified time in the future. Read testimonials and reviews from our clients who have achieved their goals with Baremetrics. Uncover how companies like yours are using Baremetrics to drive growth and success. Have an thought of how other SaaS corporations are doing and see how your small business stacks up. The greatest consultants, agencies, and specialized providers that can assist you grow.

Many companies acquire payments before delivering a services or products. Whether it’s a retainer for a lawyer, a deposit on a model new car, or a prepaid gym membership, these advance funds give companies financial security whereas creating an obligation to meet https://www.quickbooks-payroll.org/. Corporations throughout industries, from retail and software to skilled companies, handle unearned revenue daily. Unearned revenue is money acquired by a enterprise for goods or services that have not but been delivered.

Categorías

Archivos

- enero 2026

- diciembre 2025

- noviembre 2025

- octubre 2025

- septiembre 2025

- agosto 2025

- julio 2025

- junio 2025

- mayo 2025

- abril 2025

- marzo 2025

- febrero 2025

- enero 2025

- diciembre 2024

- noviembre 2024

- octubre 2024

- septiembre 2024

- agosto 2024

- julio 2024

- junio 2024

- mayo 2024

- abril 2024

- marzo 2024

- febrero 2024

- enero 2024

- diciembre 2023

- noviembre 2023

- octubre 2023

- septiembre 2023

- agosto 2023

- julio 2023

- junio 2023

- mayo 2023

- abril 2023

- marzo 2023

- febrero 2023

- enero 2023

- diciembre 2022

- noviembre 2022

- octubre 2022

- septiembre 2022

- agosto 2022

- julio 2022

- junio 2022

- mayo 2022

- abril 2022

- marzo 2022

- febrero 2022

- enero 2022

- diciembre 2021

- noviembre 2021

- octubre 2021

- septiembre 2021

- agosto 2021

- julio 2021

- junio 2021

- mayo 2021

- abril 2021

- marzo 2021

- febrero 2021

- enero 2021

- diciembre 2020

- noviembre 2020

- octubre 2020

- septiembre 2020

- agosto 2020

- julio 2020

- junio 2020

- mayo 2020

- abril 2020

- marzo 2020

- febrero 2020

- enero 2019

- abril 2018

- septiembre 2017

- noviembre 2016

- agosto 2016

- abril 2016

- marzo 2016

- febrero 2016

- diciembre 2015

- noviembre 2015

- octubre 2015

- agosto 2015

- julio 2015

- junio 2015

- mayo 2015

- abril 2015

- marzo 2015

- febrero 2015

- enero 2015

- diciembre 2014

- noviembre 2014

- octubre 2014

- septiembre 2014

- agosto 2014

- julio 2014

- abril 2014

- marzo 2014

- febrero 2014

- febrero 2013

- enero 1970

Para aportes y sugerencias por favor escribir a blog@beot.cl