Blog ›

Conclusion: 15-12 months Fixed-Rate Traditional Financing Saves many Currency

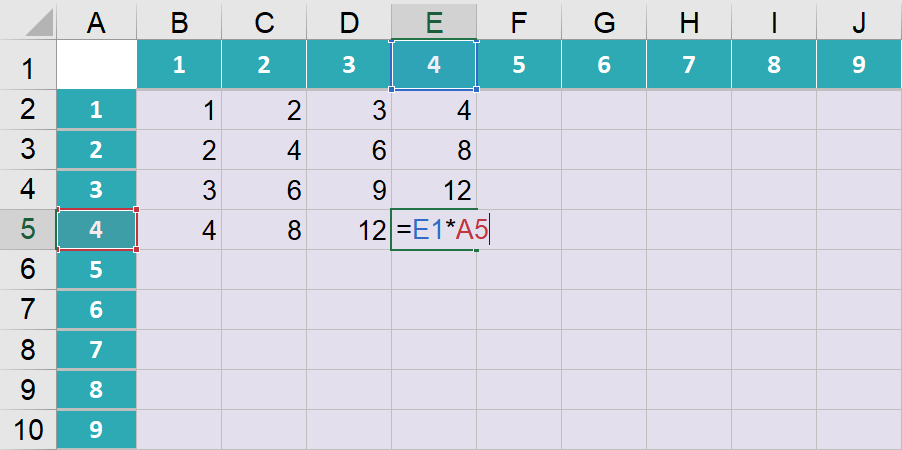

15-Season Repaired-Rate Traditional Financing

For folks who lay 20% down ($forty,000) on a fifteen-season repaired-speed financial in the step three.125% interest, their payment might be $step 1,115 and you can you would shell out almost $41,000 in total attract.

That helps you to save anywhere from $18,000107,100 in interest fees by yourself compared to most other home loan possibilities! Thought what you are able to accomplish with this variety of profit their pouch!

15-12 months Virtual assistant Financing

Remember, this new Va loan makes you put zero currency off. Thus imagine if you put no cash upon a great fifteen-seasons Va financing in the step 3.5% desire. For it example, we’ll assume your own Virtual assistant resource payment are $4,100000 while fund they to your financing because you don’t have any extra money on hand-which means you very acquire $204,100000 total. Meaning your payment per month could be regarding $1,460 plus overall appeal paid down would arrived at almost $59,000.

15-Season FHA Mortgage

Or suppose you opted for the absolute minimum advance payment out-of only 3.5% ($7,000) on a 15-season FHA financing within 3.75% desire. That have an FHA loan, you would also need to shell out nearly $cuatro,one hundred thousand in the up-top MIP from the closing (let alone the latest monthly MIP payment, which we will omit from the analogy).

Can you imagine your loans you to upwards-front side MIP into your financing, and that bumps your amount borrowed so you’re able to $197,100 plus monthly payment to more than $step 1,430. You’ll be purchasing almost $61,one hundred thousand inside the attention across the longevity of the loan.

30-Seasons Repaired-Price Traditional Mortgage

For people who lay 20% off ($forty,000) and funds the rest that have a thirty-seasons fixed-speed old-fashioned mortgage in the step three.875% appeal, you can spend $752 1 month inside the dominant and appeal. The complete notice repaid on your $160,one hundred thousand financing would visited nearly $111,one hundred thousand once the mortgage is completed.

30-Seasons Changeable-Rates Financial

What if you buy the fresh $two hundred,100 house with an advance payment away from 20% ($40,000) and you finance the remainder $160,000 that have an effective 5/step 1 variable-speed financial on a first rate of interest out of step 3.25%. (FYI: Hands usually have 31-seasons words.)

Having fun with a supply calculator, you’d start out http://www.clickcashadvance.com/payday-loans-il/riverside/ investing $696 a month to possess dominating and appeal. Pursuing the earliest 5 years, we are going to state the pace bumps upwards by simply a-quarter % each year. Of the this past year, your own payment is perfectly up to $990, and you can you’d shell out nearly $148,100000 during the interest over the life of the mortgage.

Whenever we pile such five financial choices up against each other, it’s not hard to come across the spot where the will cost you add up. For example, the fresh 29-year 5/step 1 Sleeve charge the quintessential desire of one’s bunch, because the 15-seasons FHA packs the best fees. Nevertheless fifteen-season fixed-rates antique financial which have a great 20% deposit usually saves you the most money in the finish!

Manage an effective RamseyTrusted Mortgage lender

Now you know the sort of mortgage loans, steer clear of the of these that will cripple your financial hopes and dreams! To obtain the right financial, work at our very own loved ones from the Churchill Financial. They might be laden with RamseyTrusted financial pros exactly who indeed trust enabling you accomplish personal debt-totally free homeownership.

Ramsey Possibilities has been committed to enabling anyone win back power over their cash, build wide range, grow its management knowledge, and you will enhance their life as a consequence of private advancement just like the 1992. Lots of people have tried all of our financial advice thanks to 22 instructions (together with twelve national bestsellers) authored by Ramsey Force, plus a couple syndicated broadcast reveals and you will ten podcasts, with more 17 billion each week audience. Find out more.

Within the for each and every scenario, there is presumed an effective $2 hundred,000 house get on a routine interest for every mortgage alternative. For most of these examples, you can follow together using the financial calculator and you can financial payoff calculator. (To have ease, i left out possessions income tax, homeowners insurance, PMI and you may HOA costs for each example.)

Categorías

Archivos

- febrero 2026

- enero 2026

- diciembre 2025

- noviembre 2025

- octubre 2025

- septiembre 2025

- agosto 2025

- julio 2025

- junio 2025

- mayo 2025

- abril 2025

- marzo 2025

- febrero 2025

- enero 2025

- diciembre 2024

- noviembre 2024

- octubre 2024

- septiembre 2024

- agosto 2024

- julio 2024

- junio 2024

- mayo 2024

- abril 2024

- marzo 2024

- febrero 2024

- enero 2024

- diciembre 2023

- noviembre 2023

- octubre 2023

- septiembre 2023

- agosto 2023

- julio 2023

- junio 2023

- mayo 2023

- abril 2023

- marzo 2023

- febrero 2023

- enero 2023

- diciembre 2022

- noviembre 2022

- octubre 2022

- septiembre 2022

- agosto 2022

- julio 2022

- junio 2022

- mayo 2022

- abril 2022

- marzo 2022

- febrero 2022

- enero 2022

- diciembre 2021

- noviembre 2021

- octubre 2021

- septiembre 2021

- agosto 2021

- julio 2021

- junio 2021

- mayo 2021

- abril 2021

- marzo 2021

- febrero 2021

- enero 2021

- diciembre 2020

- noviembre 2020

- octubre 2020

- septiembre 2020

- agosto 2020

- julio 2020

- junio 2020

- mayo 2020

- abril 2020

- marzo 2020

- febrero 2020

- enero 2019

- abril 2018

- septiembre 2017

- noviembre 2016

- agosto 2016

- abril 2016

- marzo 2016

- febrero 2016

- diciembre 2015

- noviembre 2015

- octubre 2015

- agosto 2015

- julio 2015

- junio 2015

- mayo 2015

- abril 2015

- marzo 2015

- febrero 2015

- enero 2015

- diciembre 2014

- noviembre 2014

- octubre 2014

- septiembre 2014

- agosto 2014

- julio 2014

- abril 2014

- marzo 2014

- febrero 2014

- febrero 2013

- enero 1970

Para aportes y sugerencias por favor escribir a blog@beot.cl