Blog ›

Banco Bilbao Vizcaya Argentaria SA BBVA Acciones-Precio, Cotizaciones y Gráfico Just2Trade

Contents

Officially known as Grupo Financiero Banorte, the bank offers retail banking products as well as investment services, annuity and insurance products, retirement funds, and warehousing capabilities. Its revenue stream includes retail banking operations, stock brokerage services, insurance, and mutual fund management. Although financial institutions today specialize in a certain type of activity, this has not always been the case. In fact, it was not until after the crash of 1929 that these two types of banking began to operate separately.

BBVA hereby reports that on 30th June 2012 has taken place the mandatory partial conversion of the Subordinated Mandatory Convertible Bonds – December 2011 issued by BBVA (the “Convertible Bonds”) outstanding by reducing the 50% of its nominal value. Therefore, the nominal value of the Convertible freelance coder salary Bond has been reduced from hundred Euros (€100) to fifty Euros (€50) as from that date. Consequently, 238,682,213 new ordinary BBVA shares have been issued, each with a nominal value of forty-nine euro-cents (€0.49), in order to attend the mandatory partial conversion of the Convertible Bonds.

Following the inside information published on November 15, 2021 and March 31, 2022, with registration numbers at the Spanish Exchange Commission 1165, 1169 and 1381, respectively, in relation with the voluntary takeover bid (the “Voluntary Takeover Bid”) for the entire share capital of Türkiye Garanti Bankası A.Ş. (“Garanti BBVA” or the “Company”) not already owned by BBVA, the Board of Directors of BBVA decided to increase the Voluntary Takeover Bid price offered in cash for each share1 of the Company from the initially announced price (12.20 Turkish Lira) to 15.00 Turkish Lira. The maximum aggregate amount of consideration payable by BBVA is 31,595 million Turkish Lira assuming all Garanti BBVA’s shareholders sell their shares. Notice is hereby given of the partial execution of the share capital reduction resolution adopted by the Ordinary General Shareholders’ Meeting of BBVA held on 18 March 2022, under item seven of its agenda, through the reduction of BBVA’s share capital in a nominal amount of 137,797,167.90 euros, and the consequent redemption of 281,218,710 own shares of 0.49 euros par value each held by the Company as treasury shares.

BBVA, pursuant to the Corporate Enterprises Act, sends the full text of the Notice of Meeting of BBVA’s Annual General Shareholders’ Meeting, to be held exclusively through telematic means foreseeably at second call on 20 April 2021, which has been published today on the daily press and on BBVA’s website. As a result of the Supervisory Review and Evaluation Process carried out by the European Central Bank , BBVA has received a communication determining a Pillar 2 requirement of 1.5%, applicable at individual and consolidated level, of which at least 0.84% must be complied with Common Equity Tier 1 . The Pillar 2 requirement remains at the same level as determined in the previous SREP Decision. Further to the notice of Inside Information of 29 October 2021, with registration number 1127 (the “Initial II”) , and to the notice of Inside Information of 19 November 2021, with registration number 1182 (the “II for First Tranche Execution”) , the Board of Directors of BBVA has agreed, within the framework of the Program Scheme, to carry out a second buyback program (the “Second Tranche”). BBVA, pursuant to the Corporate Enterprises Act, sends the full text of the Notice of Meeting of BBVA’s Annual General Shareholders’ Meeting, to be held in Bilbao, at Palacio Euskalduna, avenida Abandoibarra number 4, foreseeably on 18 March 2022, at second call, which has been published today in the daily press and on BBVA’s website.

Stocks That Hit 52-Week Lows On Monday

Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange requirements. Learn about Brazil’s São Paulo Stock Exchange, also known as BOVESPA, one of the largest stock exchanges by market capitalization in the Americas. Banorte was opportunistic in the wake of the Mexican financial crisis in the 1990s, acquiring multiple banks and building its presence throughout the country.

BBVA has resolved not to pay out the sum corresponding to the interim dividend against the financial year 2013 which, according to the Bank’s usual calendar, would be payable in January 2014, and to increase the shareholder remuneration payable in April 2014 to 17 euro-cents per share, using the remuneration scheme called Dividend Option. BBVA’s Board of Directors has resolved at its meeting held today the payment of a cash interim dividend of euro 0.08 per share on account of the 2016 dividend, to be paid on 12 January 2017. BBVA has entered today into an agreement for the acquisition from Dogus Holding A.S.

Analyst rating

Shareholders held on March 11, 2011 and corresponding to the “Dividendo Opción” program, has ended today, October 14, 2011. Further to the relevant facts dated September 14, 2012 and September 26, 2012, BBVA hereby communicates that the trading period for the free allotment rights of the free-of-charge capital increase adopted under Agenda item four section 4.2 by the Annual General Meeting of Banco Bilbao Vizcaya Argentaria, S.A. Shareholders held on March 16, 2012 and corresponding to the “Dividendo Opción” program, has ended today, October 15, 2012. Further to the relevant facts dated March 20, 2013 and April 3, 2013, BBVA hereby communicates that the trading period for the free allotment rights of the free-ofcharge capital increase adopted under Agenda item four section 4.1 by the Annual General Meeting of Banco Bilbao Vizcaya Argentaria, S.A.

BBVA hereby communicates relevant information relating to the free-of-charge capital increase resolved by the General Meeting of BBVA shareholders held on 11th March 2011, under agenda item five, section 5.2, by which a system of flexible shareholder remuneration called “Dividend Option” is to be instrumented. Accompanying this relevant event notice is an information note which indicates the expected timetable and other matters related to the Dividend Option. BBVA hereby communicates relevant information relating to the free-of-charge capital increase resolved by the General Meeting of BBVA shareholders held on 16th March 2012, under agenda item four, section 4.2, by which a system of flexible shareholder remuneration called “Dividend Option” is to be instrumented.

- The judgment of the Court of Justice of the European Union regarding the preliminary rulings filed by some Spanish judges and courts about whether the time limitation for the refund of amounts in the so-called “cláusulas suelo” in loans with consumers, established by the Spanish Supreme Court in its Judgment dated May 9, 2013, among others, is compliant with Directive 93/13/EEC, has been published today.

- BBVA has completed today the acquisition of a 100% of the share capital of Unnim Banc, S.A.

- Accompanying this relevant event notice is an information note related to the referred free-of-charge capital increase.

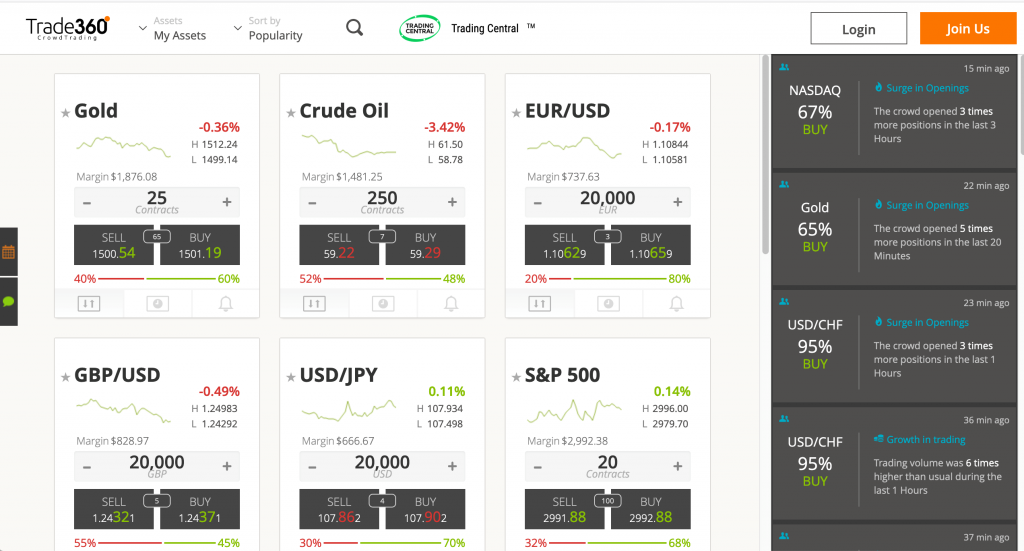

- BBVA Trader makes this easier by providing objective information on all markets, and in real-time.

- On July 13th, 2021, Moody’s Investor Service (Moody’s) upgraded BBVA’s subordinated debt rating by one notch from Baa3 to Baa2, with a stable outlook.

- BBVA has reached an agreement with the company “Neon Payments Limited” (the “Company”) for the subscription of 492,692 preference shares of the Company (the “Shares”), representing approximately 21.7% of its share capital, through a share capital increase and in consideration of approximately USD 300 million (the “Subscription”).

Shareholders held on March 15, 2013 and corresponding to the “Dividendo Opción” program, has ended today, April 22, 2013. Further to the relevant facts dated September 13, 2013 and September 25, 2013, BBVA hereby communicates that the trading period for the free allotment rights of the free-of-charge capital increase adopted under Agenda item four section 4.2 by the Annual General Meeting of Banco Bilbao Vizcaya Argentaria, S.A. Shareholders held on March 15, 2013 and corresponding to the “Dividendo Opción” program, has ended today, October 14, 2013. Further to the relevant facts dated March 14, 2014 and March 26, 2014, BBVA hereby communicates that the trading period for the free allocation rights of the free-of-charge capital increase adopted under Agenda item four section 4.1 by the Annual General Meeting of Banco Bilbao Vizcaya Argentaria, S.A.

They represent demand in the market, or colloquially, “the money” willing to buy shares. There are also the sellers, who want to obtain money in exchange for the stock they own. They represent supply in the market – or in stock market slang, “the paper” – the shares up for sale. Standard & Poor´s has lowered the rating of the preferred shares of more than 60 European financial institutions. “BBVA International Preferred SA”, a subsidiary guaranteed at 100% by BBVA, has published an exchange offer in relation to 3 issues of preferred securities sold to institutional investors for a nominal amount of approximately 1,500 million euros. On January 29, 2010, Fitch Ratings revised the ratings of 592 hybrid securities issued by financial institutions worldwide.

Banco Santander Mexico SA Institución de Banca Múltiple Grupo Financiero Santander Mexico

Further to the relevant event published on April 27, 2020, you are hereby informed that, on the date hereof, and after obtaining the required authorizations, BBVA Seguros, S.A. De Seguros y Reaseguros (BBVA Seguros”) has transferred to Allianz, Compañía de Seguros y Reaseguros, S.A. (“Allianz”), half plus one share in BBVA Seguros Generales, Compañía de Seguros y Reaseguros, S.A. On July 13th, 2021, Moody’s Investor Service (Moody’s) upgraded BBVA’s subordinated debt rating by one notch from Baa3 to Baa2, with a stable outlook.

(“CX”) into BBVA has been registered today at the Bizkaia Commercial Registry. As a result of the Supervisory Review and Evaluation Process carried out by the European Central Bank , BBVA has received a communication from the ECB requiring BBVA to maintain, on a consolidated basis, effective from the 1st of January 2017, trading silver forex a phased-in total capital ratio of 11.125%. On July 31st, 2017 DBRS Ratings Limited has upgraded BBVA’s Cédulas Hipotecarias rating by two notches to AAA from AA, as a result of the incorporation of new performance data for BBVA’s mortgage portfolio in accordance with its methodology for mortgage covered bonds.

Daniel Kurt is an expert on retirement planning, insurance, home ownership, loan basics, and more. Daniel has 10+ years of experience reporting on investments and personal finance for outlets like RothIRA.com, AARP Bulletin, and Exceptional magazine, in addition to being the “Bank of Dad” column writer for Fatherly.com. He earned both his Bachelor of Science in business administration and his Master of Arts in communication from Marquette University.

The Board of Directors of BBVA has approved an issuance of securities contingently convertible into ordinary shares of BBVA (the “Securities”) up to a maximum amount of 1,000 million euros, excluding the shareholders’ pre-emption right (the “Issuance”). Grupo Aval Acciones y Valores SA is a Colombia-based holding company primarily engaged, through its subsidiaries, the richest man in babylon review in the acquisition, purchase and sale of stocks, bonds and other securities of companies active in the financial sector. The Company provides a variety of financial services and products across the Colombian market, ranging from traditional banking services, such as loans and deposits to pension and severance fund management, as well as the provision of legal…

Top Ranked Value Stocks to Buy for May 13th

Accompanying this relevant event notice is an information note related to the Dividend Option. BBVA hereby communicates relevant information relating to the free-of-charge capital increase resolved by the General Meeting of BBVA shareholders held on 15th March 2013, under agenda item four, section 4.1, by which a system of flexible shareholder remuneration called “Dividend Option” is to be instrumented. BBVA hereby communicates relevant information relating to the free-of-charge capital increase resolved by the General Meeting of BBVA shareholders held on 15th March 2013, under agenda item four, section 4.2, by which a system of flexible shareholder remuneration called “Dividend Option” is to be instrumented.

On the other hand, wholesale banks specialize in the provision of services in large operations, generally with large companies and organizations. BBVA Trader, the platform BBVA launched last December, offers all the services and contents that the users with a trader and heavy-trader profile look for in a trading platform. BBVA Trader lets users trade stock, warrants and ETFs and offers extensive training that covers everything from the most basic, to the most advanced concepts.

( “BBVA Panamá”) to Leasing Bogotá, S.A., Panamá, a subsidiary of Grupo Aval Acciones y Valores, S.A. Corpbanca, a Chilean company, announced on December 12 it had initiated a competitive bidding process for a potential consolidation of its business in Chile and abroad. In relation to the news published today and further to a request by the Spanish Securities and Exchange Commission, BBVA communicates that it is participating in said process in order to analyse the strategic viability of a possible combination of the banking businesses of both groups in Chile and Colombia. Further to the relevant information disclosed by BBVA to the markets on January 23, 2015, and once all the contractual conditions have been met, BBVA announces that it has completed the sale of 4.9% interest in China CITIC Bank Corporation Limited to UBS AG, London Branch. Further to the relevant information disclosed by BBVA to the markets on December 23, 2014, and once all the contractual conditions have been met, BBVA announces that it has completed the sale to China CITIC Bank Corporation Limited , of its stake of 29.68% in CITIC International Financial Holdings Limited , a non-listed subsidiary of CNCB domiciled in Hong Kong.

Buying and selling stock: how the stock market works

As of June 30, 2017, the unrealized losses related to this stake amounted to €880 million and were recorded as a reduction of the Group’s total equity. As a result of the evolution of Telefonica’s stock price, as of December 31, 2017 these losses amounted to €1,123 million. BBVA has reached an agreement with The PNC Financial Services Group, Inc. for the sale of 100% of the capital stock of its subsidiary BBVA USA Bancshares, Inc., which in turn owns all the capital stock of the bank, BBVA USA, as well as other companies of the BBVA group in the United States with activities related to this banking business (the “Transaction”). BBVA has reached an agreement with the company “Neon Payments Limited” (the “Company”) for the subscription of 492,692 preference shares of the Company (the “Shares”), representing approximately 21.7% of its share capital, through a share capital increase and in consideration of approximately USD 300 million (the “Subscription”). It has been decided to propose to the Board, in the next board meeting to be celebrated next December 22, the adoption of the decision to distribute the third gross interim dividend against 2009, which would be paid on December 28, 2009, amounting to 0,09 euros for each of all current issued shares. The board of directors of BBVA, at its meeting held today, May 4, 2011, has resolved to appoint the director Mr. José Maldonado Ramos as member of the Executive Committee.

BBVA has reached today an agreement with “Oriental Financial Group Inc.” to sell its business in Puerto Rico1 for a total price of 500 million USA dollars. BBVA hereby reports that on 30th June 2013 has taken place the mandatory total conversion of the Subordinated Mandatory Convertible Bonds – December 2011 outstanding issued by BBVA (the “Convertible Bonds”). In relation to the news published today in the media regarding a potential increase of BBVA’s stake in the Turkish bank Turkiye Garanti Bankasi, AS , BBVA confirms that it is in advanced negotiations with Dogus Holding AS, , the acquisition of part of the latter´s shareholding in Garanti, though an agreement has not been yet reached.

Standard & Poor’s Ratings Services (S&P) has today upgraded BBVA’s long-term rating (“Issuer Credit Rating – ICR”) to BBB+ from BBB. As a result of the supervisory review and evaluation process carried out by the European Central Bank , BBVA has been communicated by the ECB its requirement to maintain a common equity tier 1 phased-in capital ratio of 9.5%, both on a consolidated and an individual basis. Regarding the news published today, BBVA confirms that a proposal of a new organizational structure for the Group and a new top management team will be submitted tomorrow to the Board of Directors for approval. More information on the new structure and management chart proposed is included in the press release attached.

In relation to the relevant event dated December 22nd, 2015, BBVA hereby communicates that the ex-dividend date will be January 12th, 2016 instead of January 11th, 2016, as initially stated. The Board of Directors of BBVA, in its meeting held today 31st March, 2016, has resolved to modify the composition of its Committees , and to create a new Committee on IT and Cybersecurity. BBVA has reached an agreement with a subsidiary of Cerberus Capital Management, L.P. (“Cerberus”) for the creation of a “joint venture” to which the real estate business of BBVA in Spain will be transferred (the “Business”). BBVA will contribute the Business to a single company (the “Company”) and will sell 80% of the shares of such Company to Cerberus at the closing date of the transaction.

Categorías

Archivos

- abril 2024

- marzo 2024

- febrero 2024

- enero 2024

- diciembre 2023

- noviembre 2023

- octubre 2023

- septiembre 2023

- agosto 2023

- julio 2023

- junio 2023

- mayo 2023

- abril 2023

- marzo 2023

- febrero 2023

- enero 2023

- diciembre 2022

- noviembre 2022

- octubre 2022

- septiembre 2022

- agosto 2022

- julio 2022

- junio 2022

- mayo 2022

- abril 2022

- marzo 2022

- febrero 2022

- enero 2022

- diciembre 2021

- noviembre 2021

- octubre 2021

- septiembre 2021

- agosto 2021

- julio 2021

- junio 2021

- mayo 2021

- enero 2021

- diciembre 2020

- octubre 2020

- julio 2020

- febrero 2020

- noviembre 2016

- agosto 2016

- abril 2016

- marzo 2016

- febrero 2016

- diciembre 2015

- noviembre 2015

- octubre 2015

- agosto 2015

- julio 2015

- mayo 2015

- abril 2015

- marzo 2015

- febrero 2015

- enero 2015

- diciembre 2014

- noviembre 2014

- octubre 2014

- septiembre 2014

- agosto 2014

- julio 2014

- abril 2014

- marzo 2014

- febrero 2014

- febrero 2013

Para aportes y sugerencias por favor escribir a blog@beot.cl