Blog ›

4 times you ought to get a house collateral mortgage (and you will four times do not)

If you’ve been researching the loan possibilities in today’s economy, you’re well-aware you to definitely borrowing money boasts a hefty price mark at this time due to rates getting raised along the panel. What you may perhaps not realize, regardless if, is the fact because the mediocre cost towards playing cards and private fund was resting throughout the double digits, there are some apparently cheaper borrowing from the bank options available.

And, among the best immediately is a house equity mortgage . After all, not simply manage home owners possess high degrees of family guarantee already, but the average domestic guarantee financing costs was reduced versus of a lot solutions. So, that have home values soaring for the past number of years, the common homeowner grew to become looking at almost $three hundred,000 home based equity already – and is lent up against at a level less than nine% normally.

Consequently, of several homeowners are now actually opting for household collateral funds as his or her preferred borrowing means. And you may, for the ideal person in best facts, a property equity mortgage renders loads of experience since the an affordable answer to accessibility loans. not, a property collateral loan is not the proper move around in all of the times, so it’s important to discover when you should, and you can ought not to, make use of this borrowing solution.

When you wish a fixed, foreseeable speed into currency you borrow

Home equity fund are an appealing credit choice as they promote a fixed interest towards the longevity of the mortgage, versus the fresh varying costs that include home guarantee traces regarding borrowing (HELOCs) , that may fluctuate through the years and can lead to commission wide variety so you’re able to move times-to-week. This repaired-price framework will provide you with a clear knowledge of your will set you back and you will commission agenda in the beginning. So, while have a peek at this link seeking to fee predictability, this aspect out-of home equity fund would be an enormous benefit.

When you’re deploying it so you’re able to bail-out out-of bad patterns

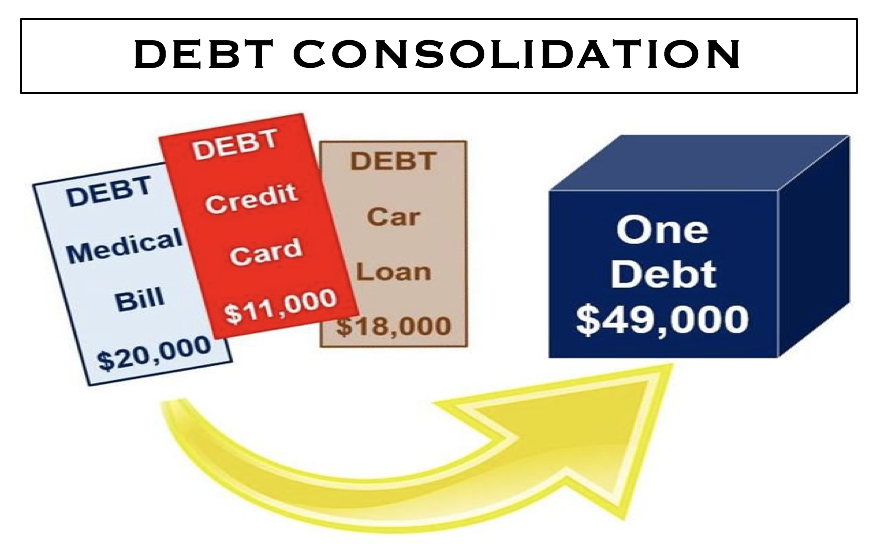

A home guarantee financing helps you consolidate obligations within a down price, it wouldn’t improve a lot of time-standing financial obligation situations otherwise a having to pay state afflicting all your family members money. In the event the personal debt things are caused by these condition, using a lump-share mortgage to pay off your debts simply reset the brand new clock up until the individuals balances possibly collect again subsequently. And, or even target the root overspending factors, a loan makes an enthusiastic upside-off finances way more unsustainable.

Preferably, family collateral finance will be familiar with fund big you to definitely-date demands , commands and financial investments that may pay back otherwise escalation in really worth through the years. They need to not be utilized since the a money pool to fund discretionary, continual expenses and you will wants such as luxury holidays, regular shopping splurges or other frivolous expenditures that will sink the newest loans without any long-term go back.

Because household guarantee loans normally have a phrase of 5 so you can 10 years with full repayment due by the end day, you may not have time staying in our home in order to completely benefit and you can recover the expense from taking right out the loan if you plan on the selling in the future. In these cases, you must know the brand new loan’s identity instead of their requested control timeline.

Once you expect interest rates to decrease in the near future

When the signs is actually pointing in order to rates declining across the next six so you’re able to 1 year, taking right out a fixed-speed house equity mortgage now you are going to indicate securing yourself into the good higher rate than simply for those who waited. Within this scenario, an excellent HELOC could be a far greater alternative .

In place of household equity funds the place you discover loans into the a swelling sum, HELOCs present a good revolving personal line of credit to attract regarding as required, just like a charge card. Moreover, HELOCs include varying interest rates that change according to the broad rate ecosystem. Anytime interest rates drop later, your HELOC costs manage drop-off accordingly, helping you save towards the credit will cost you.

The conclusion

Ahead of making use of the house’s guarantee having a property security loan, make sure to very carefully assess their small- and a lot of time-label financial situation to choose if a house guarantee loan are it is useful for your requirements. Whenever put responsibly, domestic equity fund would be an effective economic device. However, they want prudent considered and you can keeping track of to avoid putting your most important house your house’s equity within way too many chance.

Angelica Einfach is actually elderly editor to own Controlling Your finances, where she writes and you may edits articles towards the a range of individual money information. Angelica prior to now kept modifying spots from the Effortless Dollars, Focus, HousingWire or other financial products.

Categorías

Archivos

- diciembre 2025

- noviembre 2025

- octubre 2025

- septiembre 2025

- agosto 2025

- julio 2025

- junio 2025

- mayo 2025

- abril 2025

- marzo 2025

- febrero 2025

- enero 2025

- diciembre 2024

- noviembre 2024

- octubre 2024

- septiembre 2024

- agosto 2024

- julio 2024

- junio 2024

- mayo 2024

- abril 2024

- marzo 2024

- febrero 2024

- enero 2024

- diciembre 2023

- noviembre 2023

- octubre 2023

- septiembre 2023

- agosto 2023

- julio 2023

- junio 2023

- mayo 2023

- abril 2023

- marzo 2023

- febrero 2023

- enero 2023

- diciembre 2022

- noviembre 2022

- octubre 2022

- septiembre 2022

- agosto 2022

- julio 2022

- junio 2022

- mayo 2022

- abril 2022

- marzo 2022

- febrero 2022

- enero 2022

- diciembre 2021

- noviembre 2021

- octubre 2021

- septiembre 2021

- agosto 2021

- julio 2021

- junio 2021

- mayo 2021

- abril 2021

- marzo 2021

- febrero 2021

- enero 2021

- diciembre 2020

- noviembre 2020

- octubre 2020

- septiembre 2020

- agosto 2020

- julio 2020

- junio 2020

- mayo 2020

- abril 2020

- marzo 2020

- febrero 2020

- enero 2019

- abril 2018

- septiembre 2017

- noviembre 2016

- agosto 2016

- abril 2016

- marzo 2016

- febrero 2016

- diciembre 2015

- noviembre 2015

- octubre 2015

- agosto 2015

- julio 2015

- junio 2015

- mayo 2015

- abril 2015

- marzo 2015

- febrero 2015

- enero 2015

- diciembre 2014

- noviembre 2014

- octubre 2014

- septiembre 2014

- agosto 2014

- julio 2014

- abril 2014

- marzo 2014

- febrero 2014

- febrero 2013

- enero 1970

Para aportes y sugerencias por favor escribir a blog@beot.cl